In recent years, the investment landscape has witnessed a profound transformation driven by the growing importance of stewardship and sustainable investing. Asset managers are increasingly recognising the need to integrate Environmental, Social, and Governance (ESG) factors into their decision-making processes to mitigate risks, identify opportunities, and deliver long-term value for investors. Central to this evolution is the emergence of research management systems (RMS), which play a pivotal role in supporting asset managers in their stewardship and sustainable investing endeavors. This whitepaper explores the evolution of RMS and its critical role in empowering asset managers to navigate the complexities of stewardship and sustainable investing effectively.

Evolution of Stewardship and Sustainable Investing:

Traditionally, stewardship and sustainable investing were considered niche strategies, often relegated to the sidelines of mainstream investment practices. However, in recent years, there has been a paradigm shift driven by several key factors:

- Rise of ESG Integration: Increasing recognition of the materiality of ESG factors in investment decision-making has propelled the integration of sustainability considerations into mainstream investment strategies. Asset managers are now incorporating ESG criteria to assess risks, identify opportunities, and enhance long-term performance.

- Demand for Transparency and Accountability: Stakeholders, including investors, regulators, and civil society, are demanding greater transparency and accountability from asset managers regarding their stewardship practices and ESG integration efforts. There is a growing expectation for asset managers to demonstrate their commitment to responsible investment practices and disclose relevant information to stakeholders.

- Regulatory Initiatives: In the past decade, there have been a number of major regulatory developments, including the EU’s Shareholder Rights Directive (SDR II), the UK Stewardship Code,Task Force on Climate-related Financial Disclosures (TCFD), EU Sustainable Finance Disclosure Regulation (SFDR), and the UN Principles for Responsible Investment (PRI). These initiatives have imposed stricter requirements on asset managers regarding their stewardship activities and ESG integration practices. Compliance with regulatory standards has become a priority for asset managers seeking to uphold their reputations and meet investor expectations.

- Shift in Investor Preferences: Investor preferences have evolved, with a growing emphasis on sustainability, ethics, and social responsibility. Asset managers are facing increasing pressure to align their investment strategies with the values and preferences of their clients, who are increasingly seeking investments that generate positive social and environmental outcomes alongside financial returns.

The Role of a Next Generation Research Management System:

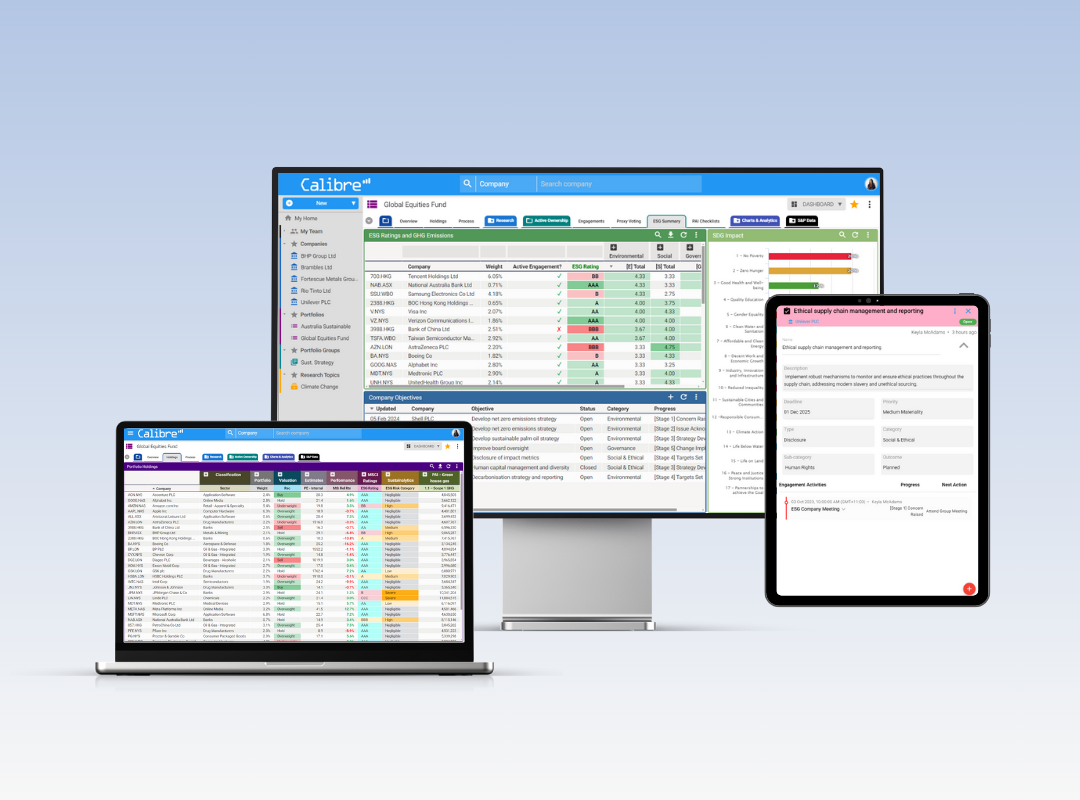

Against this backdrop of evolving stewardship and sustainable investing practices, research management systems have emerged as indispensable tools for asset managers. These systems are evolving to meet the complex and evolving needs of asset managers in the following ways:

- Data Aggregation and Integration: RMS platforms enable asset managers to aggregate disparate sources of ESG data into a centralised repository, and create and analyse proprietary research alongside external data sources. This aggregation facilitates comprehensive analysis and decision-making by providing asset managers with a holistic view of relevant information.

- Standardising of Research Processes: RMS platforms support asset managers in standardising research methodologies and workflows for evaluating ESG factors. By structuring the research process within the system, asset managers can ensure consistency, rigour, and compliance with regulatory standards.

- Quantification of Insights: RMS platforms facilitate the quantification of ESG insights and metrics, allowing asset managers to measure the impact of ESG factors on investment performance. By quantifying the materiality of ESG issues, asset managers can enhance transparency, accountability, and communication with stakeholders.

- Efficient Analysis and Action: Next Generation RMS platforms streamline the process of analysing companies and portfolios based on ESG criteria, enabling asset managers to identify trends, risks, and opportunities efficiently. This efficiency empowers asset managers to take timely action to mitigate risks, capitalise on opportunities, and drive positive outcomes for investors and society.

- Activity Planning and Tracking: With a next generation RMS, asset managers can efficiently plan and track engagement activities with investee companies. The system provides a centralised space to document engagement initiatives, monitor progress, and ensure follow-up actions are executed, enhancing accountability and effectiveness.

- Risk, Compliance and Regulatory Reporting: As a central repository of an Asset Manager’s data, research and engagement activities, a next generation RMS is uniquely positioned to help Asset Managers meet evolving reporting requirements. With audit trails and comprehensive documentation capabilities, RMS platforms provide asset managers with the tools to effectively navigate reporting requirements and showcase their commitment to responsible investment practices.

As stewardship and sustainable investing continue to gain prominence in the investment landscape, the role of research management systems becomes increasingly critical. These systems play a central role in empowering asset managers to navigate the complexities of stewardship and sustainable investing effectively. By facilitating data aggregation, standardising research processes, quantifying insights, and streamlining analysis and action, RMS platforms enable asset managers to uphold their fiduciary duties, meet regulatory requirements, and deliver long-term value for investors while advancing sustainability goals.

As the evolution of stewardship and sustainable investing continues, RMS platforms will become increasingly essential tools for asset managers seeking to align their investment practices with the values and expectations of their stakeholders.